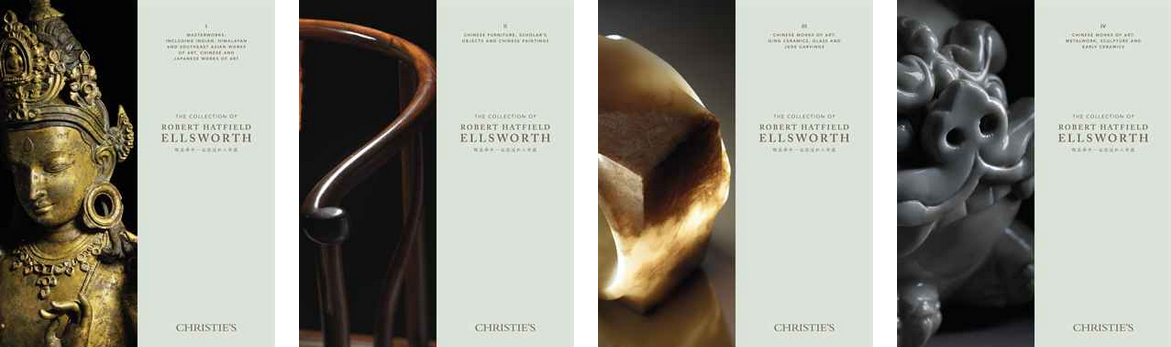

2015’s Asia Week has proved itself to be one of the most lucrative and exciting art events of the year. A barrage of gallery and museum shows, lectures, and auctions litter the art scene in celebration of artwork from multiple nations. High predictions of sales were reported to be around the $250 million dollar range, in large part owing to the excitement over the Robert Hatfield Ellsworth sale at Christies.

Ellsworth’s prestigious collection contained Indian, Himalayan, Southeast Asian, Chinese, and Japanese art and is one of the largest of estates Asian art ever to come to auction. Considering that all 57 lots sold in Part I, it appears that this estimate may have been correct - including buyer’s premium this part of the collection totaled $61,107,500.

Part I – Masterworks Including Indian, Himalayan & Southeast Asian Works of Art, Chinese & Japanese Works of Art, had the highest selling works of the entire collection. The most expensive of which was the set of four 17th Century Huanghulai Horseshoe-back arm chairs that sold for over $9 million (estimate of $800,000 – $1.2 million). Another work which defied its estimate was the Gilt Bronze figure of a Seated Bear from China created in the Western Han Dynasty (200 BC – 8 AD) which was estimated to sell for between $200,000 to $300,000 and sold for $2.8 million. According to our Asian art specialist collectors were enamored by this small totem - its rare pose and subtle characterization.

However, it was not just Chinese art that did well in the sale. The second highest price was for a large gilt bronze sculpture of Avalokiteshvara from 13th Century Nepal which sold for $8.2 million (estimate of $2-3 million). A “rare and important” bronze figure of a seated Yogi, possibly Padampa Sangye sold for $4.8 million, a little more than $3 million over the high estimate.

Part II, which included Chinese furniture, scholar’s objects, and Chinese paintings, still reached high prices and totaled $39,137,625. Part III – Chinese Works of Art: Qing Ceramics, Glass & Jade totaled $8,189,875, Part IV – Chinese Works of Art: Metal, Sculpture & Early Ceramics $15,840,625, Part V – European Decorative Arts, Carpets, Old Master Paintings & Asian Works of Art $6,207,688 and Part VI – The Library $1,176,875. The extraordinary results of these sales pay tribute to Ellsworth’s genius in the field of Asian art - something for which OTE can attest, as over the years he advised our firms president on the Asian market and, in particular, the estate of C.C. Wang.

The Ellsworth sale has amounted $132 million at auction, no doubt in large part because of the incredible provenance of his collection. As the Asian art market is becoming more overheated and frenzied, provenance is becoming increasingly more important in legitimizing extraordinarily high prices for classical Chinese art.

Although they were arguable overshadowed by the Ellsworth sale at Christie’s, Sotheby’s Asia week sales also did well. Their most successful sale appears to be Fine Classical Chinese Paintings & Calligraphy which netted them $41,441,375.

However Asia week is not just about big sales, it is also an amazing time to learn more about the art history and development of countries throughout Asia. A lecture I attended at the Korean Society, ‘Adoption, Assimilation, Transformation,’ with Robert D. Mowry discussed some of the most important developments in Korea’s art history and its relationship with China.

During the lecture Mr. Mowry spoke about the distinctly Korean style of landscape paintings typified by the painter Jeong Seon 정선 / 鄭敾 (1676–1759), whose pen name Gyeomjae meant humble study. He lived during the Joseon Dynasty and is one of the few known Korean painters to move away from traditional Chinese styles. Another, Shin Yun-bok (1758-early 19th C), paintings of people reveal a humor that is also uniquely Korean. Their paintings present a contextual history for some of Korea’s modern painters such as An Jung-sik (안중식, 1861-1919).

Overall it was a great week to experience some of the world’s most beautiful art and culture.